CFA Program

Since it was first introduced in 1963, the Chartered Financial Analyst designation, or CFA charter, has become one of the most highly sought after professional credentials in the finance world due to its enormous benefits to holders. Earning the CFA Charter demonstrates a dedication to professionalism and mastery of key skills needed for career advancement in the financial industry.

The CFA Program is administered by the CFA institute and organized into three levels. Each subsequent level exam must be passed as part of the requirement to earning the coveted CFA Charter.

CFA Program Levels

Level I

CFA Level I

The Level I curriculum sets the foundation but covers a lot of material - across ten topics split into over 90 learning modules.

Level II

CFA Level II

Level II expands on the fundamentals of Level I but goes deeper in terms of analysis and calculation.

Level III

CFA Level III

The Level III curriculum is much more heavy weighted to portfolio management and wealth planning.

Enrollment Requirements

To enroll in the CFA Program and register for the Level I CFA exam, you must meet one of the following requirements:

- Bachelor’s Degree

- Complete a bachelor’s program or equivalent and received a university or college degree

- Undergraduate Student

- As long as the exam date is 23 months or fewer before the graduation month of the bachelor's degree or equivalent

- Note, effective Nov 1, 2022, eligibility to enroll is extended by one year to include students with two years remaining in their undergraduate studies. For additional details, see the CFA Institute Media Release

- Professional Work Experience

- 4,000 hours of eligible work experience and/or higher education that was acquired over a minimum of three years, prior to the date of registering for the Level I exam. The work experience and education hours cannot overlap.

- International Travel Passport (Required)

Earning The Charter

Pass the CFA Exams

- Passing all three exams is one of the requirements for earning the Charter Financial Analyst designation

Achieve Work Experience Requirements

At least 4,000 hours of experience are required, completed in a minimum of 36 months.

The work experience requirements can be completed before, during or after participation in the CFA program. Professional work experience does not need to be investment related. However, it must involve the application of higher-level judgement & business skills.

Apply for CFA Institute Membership

- Apply to become a regular member of CFA Institute

Submit Letters of Reference

When you apply for membership with the CFA Institute, you will be required to submit 2 - 3 professional references, each of which will be asked to remark on your job experience & professional conduct.

- Two (2) references are required, if one of the references is an active regular member of the corresponding local society

- Three (3) references are required if none of them is an active local society member

Meet the Professional Conduct Admission Criteria

Candidates must attest that they are in compliance with the Professional Conduct Statement to be eligible.

Become a Charterholder

Once you've passed all three levels of the CFA exam, fulfilled your work requirements, and submitted two to three letters of reference, and been approved as a member with the CFA Institute, you will have earned the CFA charter.

CFA Program Exam Dates

Level I Exam Dates

May 2026 Exam Period

-

12 Aug 2025Registration & Scheduling Opens

-

14 Oct 2025Early Registration Deadline

-

03 Jan 2026Invoice Payment Deadline

-

12 Feb 2026Registration Closes

-

18 Feb 2026Scheduling Deadline

-

01 May 2026Rescheduling Deadline

-

12 - 18 May 2026CFA Exam Dates

Aug 2026 Exam Period

-

18 - 24 Aug 2026CFA Exam Dates

Nov 2026 Exam Period

-

11 - 17 Nov 2026CFA Exam Dates

Level II Exam Dates

May 2026 Exam Period

-

12 Aug 2025Registration & Scheduling Opens

-

14 Oct 2025Early Registration Deadline

-

03 Jan 2026Invoice Payment Deadline

-

12 Feb 2026Registration Closes

-

18 Feb 2026Scheduling Deadline

-

08 May 2026Rescheduling Deadline

-

19 - 23 May 2026CFA Exam Dates

Aug 2026 Exam Period

-

25 - 29 Aug 2026CFA Exam Dates

Nov 2026 Exam Period

-

18 - 22 Nov 2026CFA Exam Dates

Level III Exam Dates

Aug 2026 Exam Period

-

13 - 17 Aug 2026CFA Exam Dates

CFA Exam Calculator Policy

Two calculator models are permitted for use during the CFA Program exams.

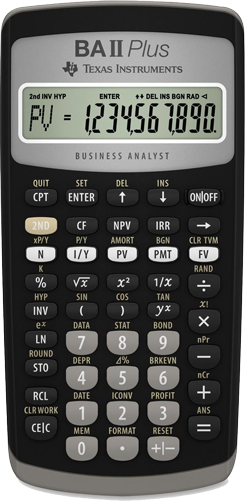

Texas Instruments

- BA II PlusTM

- BA II PlusTM Professional

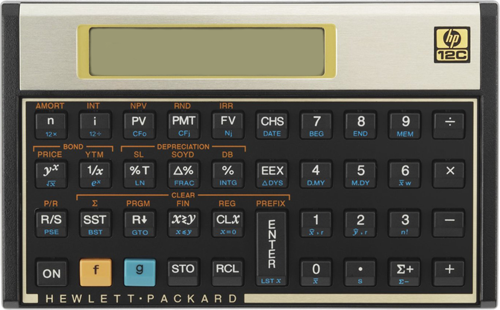

Hewlett Packard

- HP 12C

- Including the following similar models:

- HP 12C Platinum

- HP 12C Platinum 25th Anniversary edition

- HP 12C 30th Anniversary edition

- HP 12C Prestige

Details

- Bringing a second backup calculator to the exam is permitted, as long as it is one of the approved models

See our resources section for info on using the calculator: Calculator Use

We know preparation for the CFA exam can be overwhelming.

We're here to help and answer your questions.

The best way to prepare for the CFA Exam is to sign up for a CFA study prep course. In addition to finding a suitable CFA prep course, it's also crucial to ensure the necessary time is dedicated to studying. Utilizing all resources will improve changes of success on exam day.

| Topic | Level I | Level II | Level III | Functional Area |

|---|---|---|---|---|

| Quantitative Methods | 6 - 9% | 5 - 10% | - | Tools |

| Economics | 6 - 9% | 5 - 10% | 5 - 10% | |

| Financial Statement Analysis | 11 - 14% | 10 - 15% | - | |

| Corporate Issuers | 6 - 9% | 5 - 10% | - | Portfolio Management and Analysis |

| Portfolio Management | 8 - 12% | 10 - 15% | 35 - 40% | |

| Equity Investments | 11 - 14% | 10 - 15% | 10 - 15% | Assets |

| Fixed Income | 11 - 14% | 10 - 15% | 15 - 20% | |

| Derivatives | 5 - 8% | 5 - 10% | 5 - 10% | |

| Alternative Investments | 7 - 10% | 5 - 10% | 5 - 10% | |

| Ethical and Professional Standards | 15 - 20% | 10 - 15% | 10 - 15% | Ethical and Professional Standards |

According to a recent survey conducted by the CFA Institute the average study hours of CFA Candidates was as follows:

| Level | Average Study Hours |

|---|---|

| Level I | 303 |

| Level II | 328 |

| Level III | 344 |

| Level | Exam Sittings |

|---|---|

| Level I | February |

| May | |

| August | |

| November | |

| Level II | May |

| August | |

| November | |

| Level III | February |

| August |

- Create an account

- Register for a specific exam sitting

See the following link for a video outlining the full process: CFA Exam Registration Overview

- Bachelor's Degree

- Student in Final Year

- Complete Professional Conduct Statement

- BA II PlusTM

- BA II PlusTM Professional

- HP 12C

- Including the following similar models:

- HP 12C Platinum

- HP 12C Platinum 25th Anniversary edition

- HP 12C 30th Anniversary edition

- HP 12C Prestige